Many of those involved in the van auction sector have reported a busy period of activity so far this year, boosted by a good range of vehicles available as well as strong engagement from buyers.

According to auction house BCA, light commercial vehicle values strengthened early in 2025, building on the broader LCV marketplace recovery seen in recent months.

Also, two consecutive monthly value improvements in 2025 saw average prices rise by more than £800 compared to December’s value.

LCV values at BCA averaged £7,998 in February, an increase of £274 compared to January’s figure of £7,724 and equivalent to a 3.5% increase over the month.

In addition, February returned the highest average monthly value for LCVs since May 2024, well ahead of the market low point recorded in August last year when average monthly values dipped below £7,000 for the first time since 2019.

LCV values continued to outperform guide price expectations, averaging 103.7% across the month, up by 3.3 percentage points so far this year.

BCA has also reported rising levels of buyer engagement since the turn of the year and good levels of demand that seems set to continue with many customers still reporting low inventory levels.

Sold volumes continue to rise at BCA, with more than 10,000 LCVs sold in February.

Stuart Pearson, BCA COO UK said: “Currently there is a level of confidence in the LCV market that has produced some exceptional results, fuelled by a very attractive mix of stock and some very strong buyer engagement.

“Increased volume can often dilute pricing, however in a month where more than 10,000 LCVs were sold at BCA, real values increased and guide price performance lifted.”

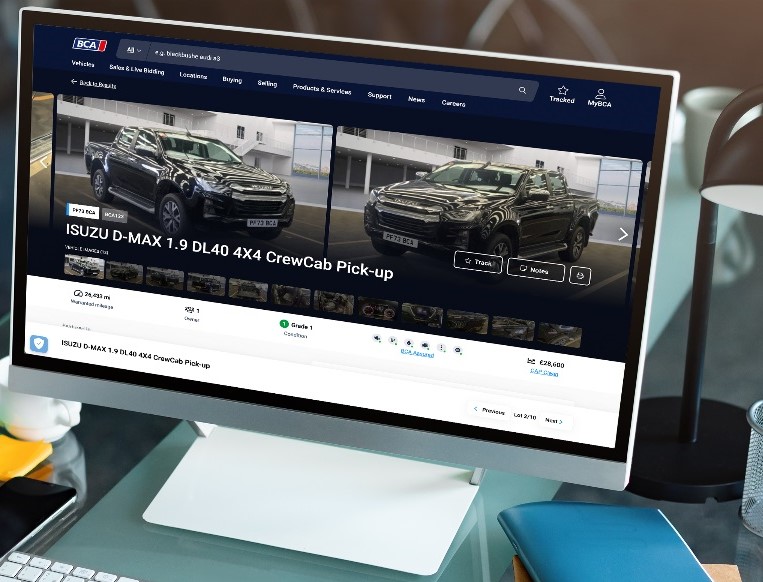

BCA said that due to its significant investment in LCV products and services, the business is able to ensure that its customers have access to up-to-date live pricing information along with a greater depth of information around vehicle condition.

Combine this with the science that supports investment in the optimal level of refurbishment, BCA’s aim is to generate more first- time sales for its customers and place stock into the market that is ready to be retailed.

Pearson added: “At the moment there’s a very healthy balance between supply and demand, which is welcome news for both sellers and buyers alike.

“March trading has continued with a similar pattern and whilst we could see some pressure as we move over the Easter period, following the sharp drop in values during 2024, the expectation is for a calmer and more predictable marketplace than experienced last year.”

Meanwhile, Manheim Auctions said LCV market health in January could be likened “to that of an Olympic athlete” as first time conversions not only increased further versus December, but also increased year on year by 10%.

Stuart Peak, LCV specialist at Manheim Auctions said: “Our total volume sold also increased by 17% vs Jan 2024 and I put this down to one thing: used vans look much more affordable this time around.

“The LCV market went through a fairly hefty price re-alignment in Q2 and Q3 of 2024, and the volume of used stock available meant it became a buyer’s market.

“We are now in a place where we’re seeing an almost perfect balance of healthy amount of used stock, strong retail demand and guide prices that are aligned to market conditions.”

Peak said that Manheim’s data shows that only one area of the LCV market is struggling – the minibus sector – likely down to an abundance of products available meaning buyers have been able to choose the cleaner, more sellable vehicles.

Specification has also impacted on the numbers, with buses without air conditioning expected to continue underperforming.

He added: “The LCV auction halls have been rammed with buyers which is backed up with exceptional numbers of users logged on to every sales event.

“While our LCV auction sites are jam packed, I must give huge credit to our operational teams that are working increased hours to keep the wheels turning.

“It’s been a perfect start to 2025, and I am predicting a very strong finish to Q1.”

Also, national vehicle remarketing specialist Aston Barclay has reported record buyer attendance, both physical and online, across its centres during the first week of its new sale schedule which began in early February.

The auction house saw a 35% increase in attendees across the week.

Aston Barclay’s site at Donington Park, which was recently announced as its new commercial super centre, saw a significant improvement in attendance for its dealer and commercial launch auction, with an 108% increase in physical buyers heading to the halls to bid, as well as a 123% increase in online buyers.

A newly launched dealer sale in Wakefield – which takes place weekly on a Tuesday – saw a 30% increase in physical buyers and a similar level (35%) of new buyers logging on to bid and buy.

Gordon Cockle, chief remarketing officer at Aston Barclay, said “With our new sales schedule offering higher volume levels and more variety in the stock we are offering to our buyers, it was great to see so many of our customers head down to the halls and celebrate with us during our launch events.

“We have had some fantastic feedback from both buyers and vendors on the improvements we have made to the auction programme, and this has come to fruition through the fantastic conversion rates we have seen as a result of a busy and bustling hall.

“Across all our centres, we have had a fantastic start to 2025, welcoming new vendors across our fleet, dealer and commercial sales.”

According to the National Association of Motor Auctions (NAMA), its members in the LCV segment have recently reported an increase in market stock compared to the period from 2021 to 2022.

Paul Hill, spokesperson for NAMA said: “Overall, NAMA members are reporting a strong start to the year. It is encouraging to see that the market is in a healthy position, with forecasts for March and April also remaining positive.”