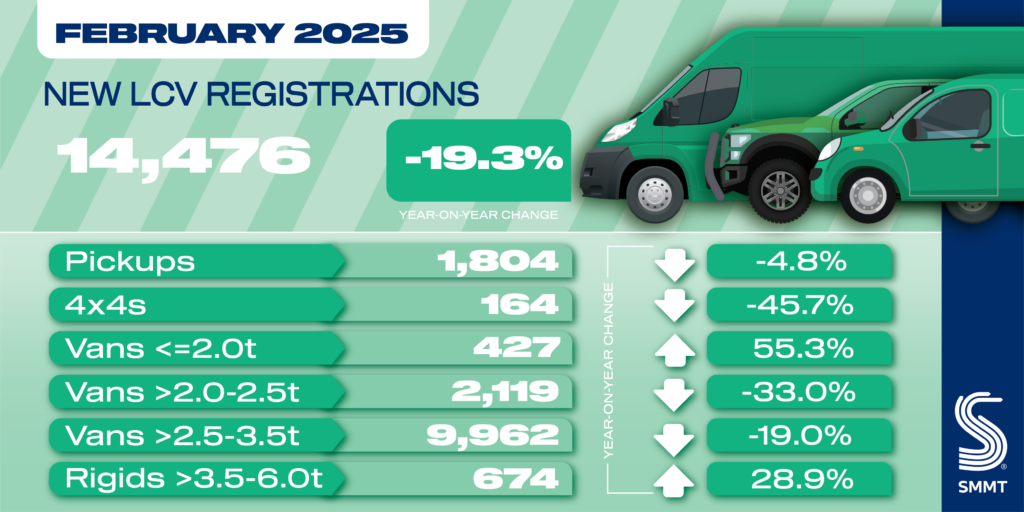

- New light commercial vehicle (LCV) registrations fall -19.3% in February to 14,476 units, in third consecutive monthly decline.

- Smaller vans seize demand, increasing by 55.3% to 427 units, as other segments contract.

- Electric van uptake grows 55.1% to 1,413 units, taking 9.7% market share – but well short of 2025’s mandated 16%.

Data download

new LCV registrations February 2025

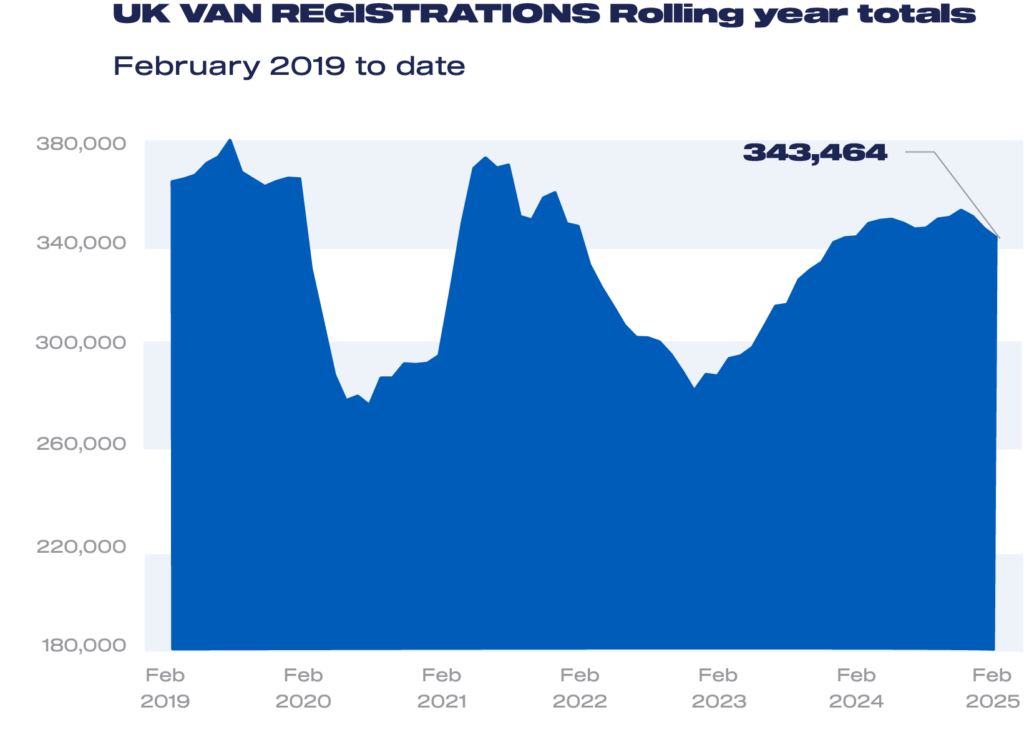

Demand for new light commercial vehicles (LCVs) fell by -19.3% in February to 14,476 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The third consecutive monthly decline led to the month’s lowest outturn since 2020,1 with February traditionally a low volume month as many operators postpone procurement until the arrival of the new March number plate.

With weak business confidence ahead of upcoming tax changes, the fall in demand impacted all but one segment, with registrations of smaller vans weighing under 2.0 tonnes showing the only increase, up 55.3% to 427 units – representing 2.9% of the market. Volumes of medium vans were down by -33.0% to 2,119 units, while larger vans, weighing greater than 2.5 to 3.5 tonnes, dropped by -19.0% to 9,962 units. The smaller segment market – 4x4s and pick-ups – also recorded declines, down -45.7% and -4.8% respectively.

In positive news, uptake of battery electric vans weighing up to 4.25 tonnes grew for the fifth consecutive month, up 55.1% to 1,413 units, with market share rising to 9.7% – up nearly five percentage points on last year.2 More than 30 zero emission van models are currently available, providing operators with increasing choice, and the industry has welcomed confirmation of the continuation of the still essential Plug-in Van Grant. Mandating faster chargepoint rollout – including van-specific charging infrastructure – will be crucial, however, to bolstering confidence, whilst reintroducing discounted VED on ZEVs is also necessary to help raise demand to levels required under market regulation.

With the industry charged to deliver a 16% zero emission new van market this year, urgent action is needed to encourage operators to switch, along with workable regulation that delivers growth and decarbonisation. The government’s review of the Zero Emission Vehicle Mandate is essential and must deliver measures and flexibilities that tackle lacklustre demand and encourage faster fleet renewal.

Mike Hawes, SMMT Chief Executive

Against an increasingly difficult economic backdrop, van manufacturers have shown resilience, but the decline was perhaps inevitable after two years of strong performance. Even in a contracting market, however, zero emission uptake is positive but still struggles to match the ambition of regulation.

While the ongoing Plug-in Van Grant provides a lifeline, we still need support to bolster operator confidence, boost demand and deliver decarbonisation. Industry has committed billions to this vital transition and the mandate review must deliver workable measures that enable that commitment to deliver our shared ambition.

Notes to editors

- LCV registrations, February 2020: 14,103 units

- SMMT’s BEV LCV registration data reflects the Vehicle Emissions Trading Scheme, in which BEVs weighing >3.5-4.25t contribute towards each manufacturer’s target, in addition to those weighing ≤3.5t.