- Vehicle production rises 17.1% compared with weak March last year, but total Q1 output down -6.3% ahead of new US tariff announcements.

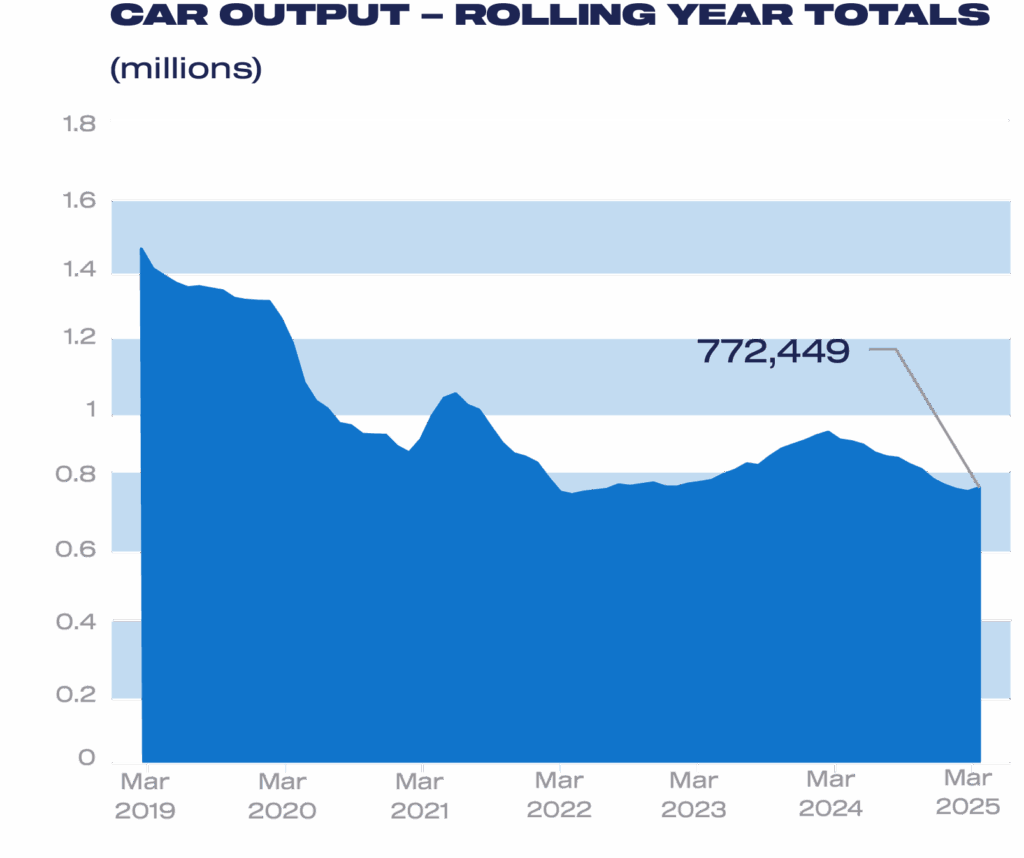

- Car output rises for first time in a year, reflecting model changes in 2024, with commercial vehicle output also up as demand stabilises following two years of post-pandemic volatility.

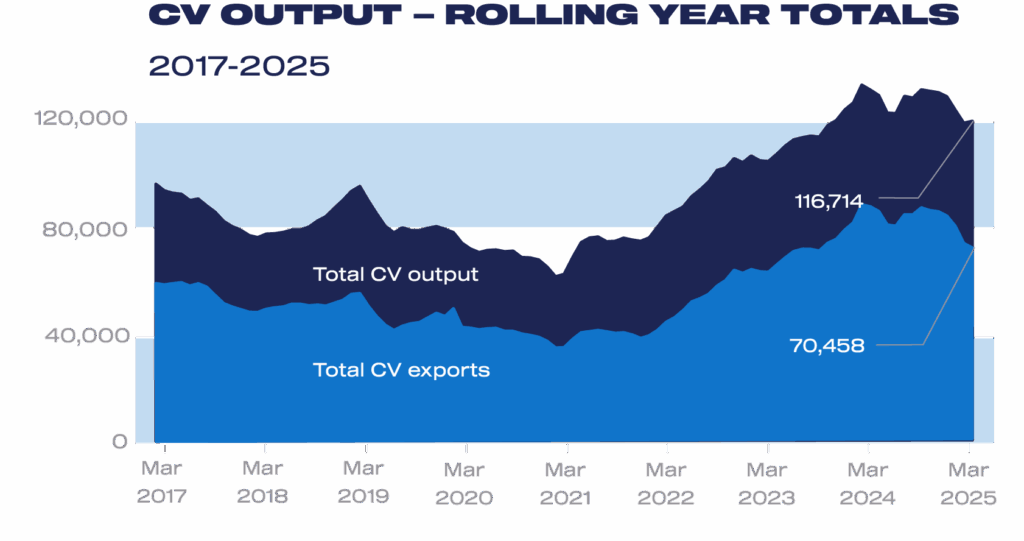

- Exports drive growth in car production, while commercial vehicle output rises through domestic demand.

File download

UK new vehicle production

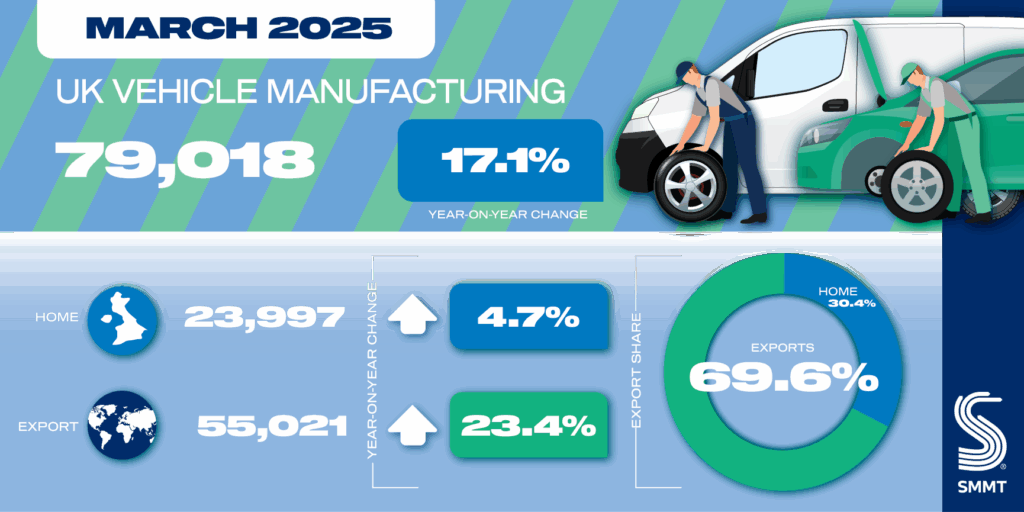

UK car and commercial vehicle production rose by 17.1% to 79,018 units last month, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Output of cars, vans, trucks, taxis, buses and coaches increased in comparison with a weak March last year, when the earlier Easter break reduced working days and significant model changeovers began to impact output.

Car manufacturing grew for the first time in 12 months, driven by robust export demand that increased by 30.6%, with almost three quarters (73.3%) of output shipped overseas. Conversely, production for the UK market fell by -6.1%. Electrified vehicle production also rose, by 38.5% – more than twice the rate of total production – to 31,661 units, to account for almost half of all UK car output (45.0%).

The recent proposed revisions to the ZEV Mandate have been welcomed by manufacturers, evidence that government recognises some of the challenges facing the industry, not least the absence of robust consumer demand for EVs which is undermining competitiveness. In addition, given the UK is a significant producer of zero emission commercial vehicles, particularly for the domestic market, extensions to the grants for plug-in vans and trucks are critical if this vital market is going to grow in accordance with mandate ambitions.

The EU continued to be the largest destination for UK car exports, accounting for 57.2% of all shipments. Ahead of the introduction of new tariffs, the US remained the second largest export market, comprising 15.0% of exports, followed by China (8.5%), Turkey (2.7%) and Japan (2.6%). Exports to all top five markets rose for the month, with the EU up by 28.9%, the US 36.1%, China 86.0%, Turkey 272.1% and Japan 91.8%.

CV production also rose, up by 8.2% to 8,700 units, in comparison with a weak March 2024 when volumes were constrained by both Easter timing, and a softening of output following 2023’s post-Covid pent-up demand. As in previous months, CV growth was driven by domestic demand, which rose by 77.9% to 5,218 units. Conversely, exports fell by -31.8% to comprise just 40.0% of output. The EU remains the sector’s largest market by far, accounting for 94.2% of exports in the month.

As a result, overall UK car production for Q1 2025 was down slightly, by -3.2%, but with exports up 4.4%, while CV output was down a more significant -27.1%, and exports down by -50.3%. Given the figures reflect the level of demand ahead of the announcements of new US tariffs, manufacturers face considerable uncertainty heading into quarter two as US demand likely weakens with knock on effects on other markets and the supply chains. Trade discussions must continue at pace to reach a deal that supports jobs, demand and growth on both sides of the Atlantic.

Increased protectionism and retaliatory tariffs being levied in key markets mean a rapid response from government is needed, given the immediate challenges facing the industry’s exports. It is also essential the UK does all it can to assure its longer term production competitiveness. Industry looks ahead to the comprehensive industrial strategy, due before the summer, which must have automotive and advanced manufacturing at its heart, and set concrete measures that support the growth of Britain’s most valuable goods export industry.

Mike Hawes, SMMT Chief Executive

A March uplift to manufacturing is overdue good news, although the performance was boosted by a comparatively weaker month last year, when holiday timings and product changeovers combined to reduce output. With the last quarter showing demand for British-built cars rising overseas, navigating the new era of trade uncertainty is now the major challenge.

Government has rightly recognised automotive manufacturing’s critical role in Britain’s export economy and must now show urgency and creativity to deliver a deal that supports our competitiveness, spurs domestic demand for the latest cleanest vehicles, and helps factory lines flourish.

The latest independent outlook – compiled ahead of rapidly changing trading conditions with the US – estimates that light vehicle production will fall -7.8% in 2025 to 818,200 units, before rising slightly by 1.2% in 2026 to 827,700 units. With a favourable government strategy, however, this could rise to 834,900 units and set the industry on the path for further growth.

SMMT Update

Sign up

SMMT Update

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields